Welcome to MoneyNerd — your weekly shortcut to how the latest news and trends shape your financial life. We’re here to keep you informed, confident and ready for whatever the economy throws your way.

In this week’s edition:

It’s tax time again. See what’s new this year.

Need that tax refund fast? Here’s one option.

Smart Money podcast: AI wants to help you shop.

Nerdy money tips.

Video: Why do people with the same income end up rich or broke?

ICYMI.

Elsewhere in money news:

Netflix reported fourth-quarter earnings and reached a new milestone — 325 million global paid subscribers. (CNBC)

Amazon is launching its biggest retail store in Chicago. (The Wall Street Journal) 🔒

Some of the best places to work in 2026 include a car wash chain and a burger joint, according to job site Glassdoor. (CBS News)

It’s tax time again

This Nerdy info is provided for general educational purposes and may not apply to your specific circumstances. NerdWallet Inc. is not a financial, tax or investment advisor and does not provide personal financial advisory services.

This coming Monday, Jan. 26, marks the first day you can file taxes for tax year 2025. They’re due by the customary date of April 15 — or Oct. 15 with an extension — making this a good time for taxpayers to get into the spirit of tax season.

We’re dedicating this edition of MoneyNerd to taxes, with a high-level view of what’s new this year, as well as resources for getting started — all drawn from NerdWallet’s deep library of tax-focused articles.

Note: Your W-2 should be in the mail from your employer soon, if it hasn’t already landed. If you haven’t received it by Feb. 2, here are steps you can take.

What’s new in 2026

The “One Big, Beautiful Bill Act” (OBBBA) signed into law on July 4, has many tax-related provisions. Some of them are permanent extensions to provisions that were in the 2017 tax bill that were scheduled to expire at the end of 2025, and some of them are new.

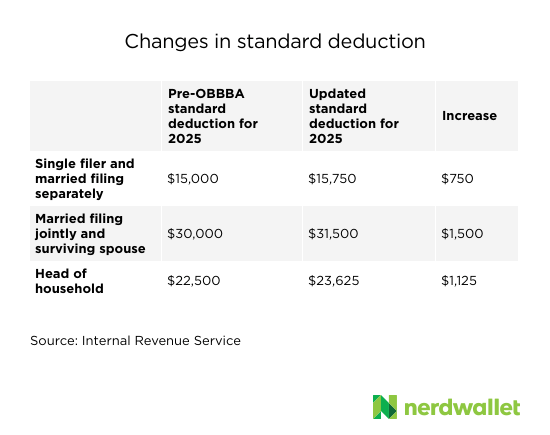

1. Increased standard deduction

The standard deduction is a fixed amount you can subtract from your income to reduce how much of it is taxed. Many taxpayers choose the standard deduction because it can result in a larger write-off than itemizing, which requires filers to qualify for and substantiate individual deductions.

The OBBBA preserved the higher standard deductions from 2017 and increased them slightly.

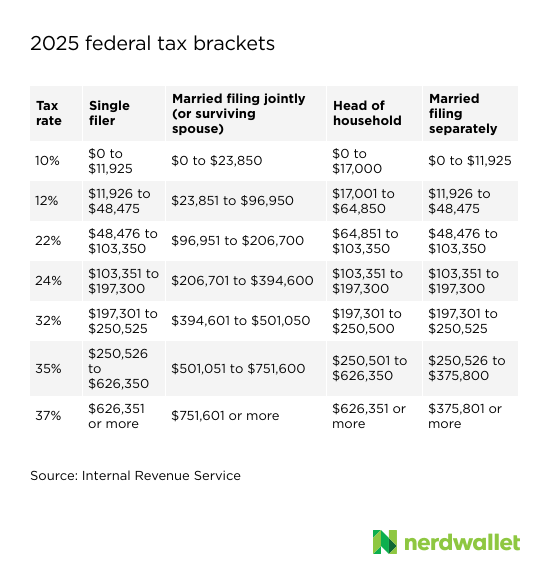

2. Adjusted federal tax brackets and tax rates

Federal income tax rates remain the same as those set in 2017, ranging from 10% at lower incomes to a top rate of 37%.

Income brackets, which determine which portion of your income gets taxed at a specific rate, have been adjusted. This means some people may keep more of their income in lower tax brackets, potentially lowering their taxes.

3. Higher limit for state and local tax deductions

The state and local tax (SALT) deduction is a federal tax break that allows filers who itemize to deduct a portion of certain state and local taxes from their taxable income. A cap of $10,000 (set under the 2017 tax bill) was due to expire, which would have eliminated the cap altogether and allowed taxpayers to deduct an unlimited amount from their federal taxes.

Instead, Congress placed a higher deduction limit of $40,000, now in place through tax year 2029. This deduction is beneficial primarily to high earners who live in a state with high state or local taxes.

4. Deductions for tips and overtime pay

New this filing season, some filers might be able to deduct up to $25,000 of tip income when they file. This new deduction results from OBBBA and will be available to filers through 2028.

This applies only to federal income tax; you may still have to pay state, local and payroll taxes (such as Medicare and Social Security) on tipped income. Nearly 70 jobs qualify for the “no tax on tips” provision, which phases out at higher incomes.

Also new: Overtime pay can be deducted — up to $12,500 for individual filers or $25,000 for married couples filing jointly — beginning with the 2025 tax year. The provision phases out for those with income above $150,000 or $300,000 for couples and ends in 2028.

5. Extra deduction for seniors — and a new way to save for children

The OBBBA established a new deduction of up to $6,000 for seniors, which is in addition to the standard deduction and will be in place through tax year 2028. The deduction phases out at higher income levels.

Meanwhile, “Trump Accounts” are about to become a reality. These new investment accounts give parents a way to save and invest for children. Under the pilot program, a $1,000 credit will be offered to U.S. citizens born between Jan. 1, 2025, and Dec. 31, 2028.

Parents of eligible children can open a Trump Account by filing Form 4547 with their 2025 taxes, or by applying online through a new website scheduled to open in July.

This is just a sample of the changes that come into play this year. In fact, the OBBBA had almost 70 tax-related provisions. Click for a summary of major tax provisions in the bill.

Ready for a pop quiz on 2025 tax changes? Take our OBBBA challenge.

Tax resources from NerdWallet:

Expecting a refund?

Big tax refunds can feel like free money — but what a refund really means is that you’ve paid too much tax over the course of the year. If you’re expecting a refund in 2025, this could be a good moment to revisit your Form W-4, which employers use to calculate how much tax to deduct.

A tax refund typically takes about 21 days for those who e-file and opt for direct deposit (the IRS is phasing out refunds by check).

If that’s not fast enough, some tax preparation companies let customers take out tax refund loans when they file their tax returns.

Tax refund loans basically work like this:

You apply for the loan at your tax filing appointment.

Approval is typically based on the amount of your anticipated refund, regardless of your credit score or income.

You can get the money (typically a portion of your refund amount) the same day. Some companies send the funds to your bank account via direct deposit. Others load it on a prepaid debit card or use a specific account designated by the tax preparer.

Spend the money however you choose.

When the IRS sends your refund, the tax preparation company will deduct the loan amount plus any fees or interest.

Both H&R Block and TurboTax offer tax refund loans with 0% APRs, making them no-cost options to access cash before the IRS disburses your refund. Some companies charge high interest rates, so read the terms carefully.

Keep in mind: Even for no-cost loans, you may still owe a fee for filing your taxes, so getting this loan makes most sense if you were planning to pay to have your taxes done anyway.

Your latest listen

ChatGPT ads could change how you spend

Is AI shopping about to turn your chatbot into a checkout line? Senior news writer Anna Helhoski joins hosts Sean and Elizabeth to discuss the rise of AI shopping inside chats. They discuss how Google and other platforms are weaving deals into AI conversations, how ads and “instant checkout” could blur the line between recommendations and advertising, and why this convenience could make impulse spending a lot easier.

Nerdy money tips:

Try a tax calculator. NerdWallet’s Federal Income Tax Calculator can help you estimate your 2026 tax refund or bill. Enter your income, age and filing status to get started.

Brush up on some common tax terms. Tax writer Bella Avila disproves the common misconception that your entire income is taxed at a single rate. A marginal tax rate is your highest tax rate.

Why people with the same income end up rich or broke

Two people can earn the exact same salary and still end up living completely different financial lives. One becomes wealthy, while the other remains stuck. Learn three financial mistakes that could keep high income earners living paycheck-to-paycheck, the habits that can help build long term wealth, the difference between an abundance mindset and a scarcity mindset and the practical steps you can start using today to get ahead.

In case you missed it

Here’s what else you may have missed this week from NerdWallet:

News writer Anna Helhoski tracked the latest gyrations in U.S. tariffs.

Personal finance writer Kimberly Palmer wrote about four ways to relaunch your finances in 2026.

Kimberly Palmer also covered three of the top January money questions from NerdWallet’s app. Check out the answers to those questions.

Data studies writer Erin El Issa doesn’t spend any money on nonessentials in the month of January. She told us why No Spend January has become her annual tradition — and how you could join her.

Credit cards writer Sara Rathner reported on President Donald Trump’s credit card APR cap proposal.

Fellow credit cards Nerd Jae Bratton dove into Bilt’s three new cards — and how you can use them to earn rewards on housing. But it’s complicated, so you’ll want to read closely.

On Jan. 22, the House cleared the final batch of funding bills, setting the stage to avert a partial government shutdown set for Jan. 30 — if the Senate approves. Read more from news writer Anna Helhoski.

Student loans writer Shannon Bradley helped parent PLUS borrowers understand what they need to do so they don’t lose access to certain repayment options.

Your MoneyNerd team: Courtney Neidel, Anna Helhoski, Rick VanderKnyff.

Was this newsletter forwarded to you? Subscribe here.

Until next week,